Motor vehicle dealers are key players in South Africa’s economy but are also susceptible to money laundering, terrorism financing, and proliferation financing abuse. As movable goods, motor vehicles can be used by criminals to launder illicit funds.

With a large informal economy in South Africa, the increased use of cash poses a high risk of money laundering, making it easy for criminals to move illegally obtained funds without the possibility of tracing the source of the funds.

While cash is still largely used in the sector, motor vehicle dealers also conduct business online, aggravating the risk of them being abused for money laundering or terrorist financing.

The FIC’s public compliance communication 58 (PCC 58) defines a motor vehicle dealer as “any person who is engaged in the business of buying, selling, or exchanging any new, used and/or second-hand self-propelled vehicle, including a vehicle having pedals and an engine, or an electric motor as an integral part thereof or attached thereto and which is designed or adapted to be propelled by these means on land, as well as any trailer and caravan.”

Motor vehicle dealers are included in the category of high-value goods dealers defined in Schedule 1 of the FIC Act, provided the value of each item or unit is valued at R100 000 or more.

Suspicious and unusual transaction reporting obligation

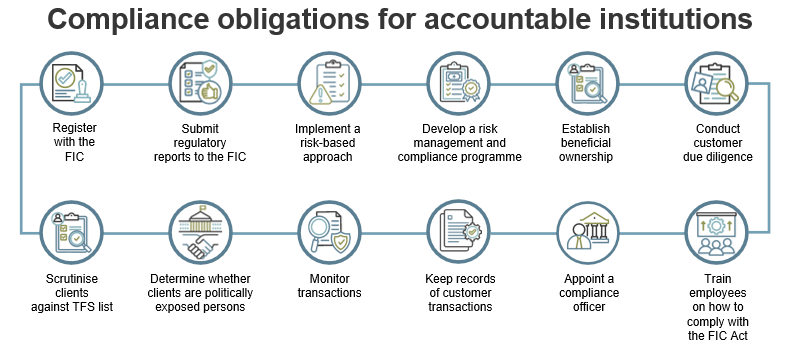

Property practitioners, as accountable institutions, must file regulatory reports on suspicious and unusual transactions and activities (STRs and SARs). Information contained in STRs and SARs is then analysed by the FIC for the production of financial intelligence reports. These are in turn shared with competent authorities for use in investigations, prosecutions, and asset forfeiture.

These reports must be filed without delay but no later than 15 days from a person becoming aware of the suspicious and unusual transaction or activity. These reports must be filed regardless of the amount of money involved. Refer to the property risk assessment for examples of indicators of potential ML, TF and PF, which could raise a suspicion.

For high-value properties, property practitioners must be particularly vigilant when conducting business that deals in high-value property, as this is recognised internationally as being attractive to criminals. There is no obligation for a property practitioner to prove that the funds involved in the transaction are linked to a crime, the report can be based on a mere suspicion.

Reporting of suspicious and unusual transactions

High-value goods dealers must file suspicious and unusual transaction reports (STRs) and suspicious activity reports (SARs) to the FIC. The information submitted to the FIC is used to develop financial intelligence which it shares with law enforcement, prosecutorial and other competent authorities for their investigations and applications for asset forfeiture.

STRs and SARs must be filed when a business knows or suspects it has received or is about to receive the proceeds of crime, knows or suspects that a terrorism or proliferation financing activity has or is about to take place.

All STRs and SARs must be submitted as soon as possible and no later than 15 days after the business becomes aware or if suspicion is raised regarding an activity or transaction.

Businesses must report suspicious transactions that have taken place, and those that have been abandoned, aborted, incomplete or interrupted. There is no monetary threshold for an SAR or STR.

Registration with the FIC

Motor vehicle dealers that fall within the definition of a high-value goods dealer must register with the FIC. Registration with the FIC is free and can be completed electronically using the online registration and reporting platform.

All registrations must be accompanied by supporting documentation including a certified identity document and an authorisation letter of the compliance officer on the high-value goods dealer’s letterhead.

Refer to the goAML registration guide for accountable institutions as well as PCC 5D for guidance on how to register.

Motor vehicle dealers can be used to facilitate money laundering, terrorist financing and proliferation financing activity through:

- The purchase of luxury motor vehicles using illegally obtained funds

- The purchase of motor vehicles using cash to disguise the activity that generated the illegal funds using cash

- The sale of goods to finance terrorist activities

- Being used as agents or front companies to move components for weapons of mass destruction across borders.